WHAT WE SEE

We often see a gap between institutional asset owners and emerging asset managers, which inhibits mutually accretive partnerships. We call this the ‘context gap’.

At Endue we work to bridge this gap.

The Context Gap

We live in an era of innovation, and yet global institutional capital continues to chase established ideas. Interactions with asset owners often suggest an inability to take a leap with emerging managers, even when they have been mandated by their boards to go beyond the tried and tested.

This is partly due to the fact that emerging managers struggle to present themselves institutionally, inhibiting asset owners from deploying long term capital.

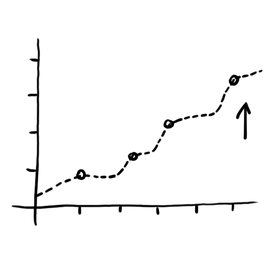

An Evolving World

Three large themes are shaping institutional investing decisions

.png)

ASIA - INVESTING & WEALTH

The need for specialist Asia managers is expanding, driven by the need for diversification and the emergence of new pockets of investable opportunities in the region. Further, as capital pools in Asia are expanding, an opportunity exists to cater to this emerging pool through a very different lens.

Differing Needs of Global Capital Pools

Capital pools differ significantly in terms of their drivers and objectives. We put our years of experience handling various capital pools, to simplify that for you.

Investor segments vary in their perception of the risk, return and impact associated with asset classes, geographies, and investment horizons.

We find that emerging managers tend to struggle with determining where their best fitment lies. We help guide our managers towards the right segments in order to channel their own and the allocator’s time towards productive conversations that have a better chance of becoming mutually accretive partnerships.

.png)